Contents

The Harmonised Commodity Description and Coding System, commonly referred to as the Harmonised System (HS) is a standardised system of names and numbers used to classify goods in international trade. The HS codes provide a universal language for customs officials to understand the type, nature, and origin of the goods being traded.

If you need help with HS codes, consider contacting a professional customs broker. EES Shipping in Perth and Sydney, offers total logistics solutions, including customs brokerage, import and export, sea freight, air freight, freight forwarding in Sydney and warehousing services. In this article, we will delve deeper into HS codes and explore their significance in international trade.

What is an HS Code?

The HS was developed by the World Customs Organisation (WCO) in 1988 and is now used by more than 200 countries. The HS codes cover almost all goods in international trade, including raw materials and finished products. The HS codes are only used for product classification and do not cover services. In Australia, the Customs Tariff Act is closely based on the HS, aka the HS Convention.

Understanding HS Codes: What are HS Codes Used for?

Customs authorities use HS tariff codes to classify and identify goods at the time of import or export. These codes play a crucial role in international trade as they are used to determine and apply the correct regulations, taxes, and customs duties.

In addition, HS codes are used by governments and customs authorities to monitor imports and exports for statistical and research purposes. HS codes are also used to assess whether the goods may be prohibited or have specific requirements for compliance. Private businesses also monitor international trade statistics and pricing using HS codes.

Moreover, HS codes are used in commercial invoices as well as in legal documents, such as bills of lading. HS codes are particularly important for these documents as they can facilitate a smooth, fast clearance process at customs.

What are the Different Types of HS Codes?

There are about 5,000 different HS codes and product categories. Let’s take a look at how they work in more detail.

How HS Codes Work: What Do HS Codes Look Like?

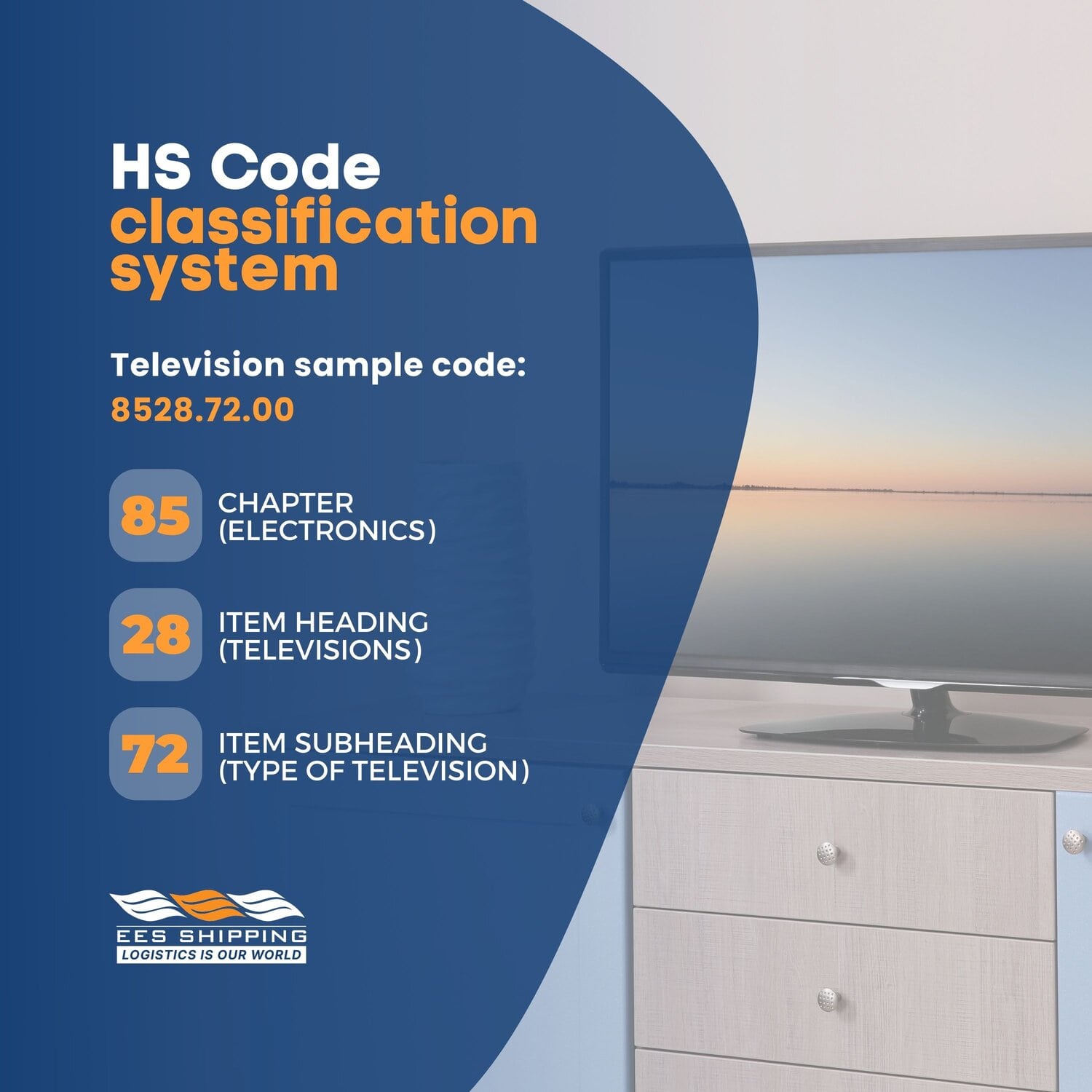

The HS code classification system is composed of six-digit codes, arranged hierarchically. Individual countries often have more categories, so they add digits to their codes to reflect this classification, resulting in codes with eight or ten digits. Each digit in the series signifies specific information about the product being classified. For instance, let’s consider a shipment of televisions:

| Digits | Explanation | Example (Televisions, code: 8528.72.00) |

| 1 to 2 | Chapter: These digits indicate general information about the commodity. There are currently 99 chapters in the HS. | 85 (electronics) |

| 3 to 4 | Item heading: These digits identify the product category. | 28 (televisions) |

| 5 to 6 | Item subheading: This provides more detailed information about the product’s characteristics. | 72 (type of television) |

The HS codes are updated every five years to adapt to changing trade environments and technological advancements.

How to Get an HS Code

You should liaise with your customs broker, who can obtain the correct HS code through the Tariff Advice System. As experienced brokers, EES Shipping can assist with this process and save you a lot of time. Alternatively, the following steps will guide you through obtaining an HS code:

Step 1: Gather information about your product

You need to familiarise yourself with your product specifications, including its material composition, function, and purpose. You’ll need to contact the customs department and provide them with the necessary information to assist you in obtaining the right code.

Step 2: Check the local regulations

Before obtaining an HS code, you need to understand the local regulations for your product. Each country has different regulations, so you need to check with the local customs department for their requirements.

Step 3: Conduct research online

You can search online to find the HS code that best fits your product. A good place to start is the WCO. Several websites offer services that allow you to search for the HS code of your product based on keywords relating to your product’s specifications.

Step 4: Consult an expert

If you’re exporting a specialised product, you may require the help of an expert customs broker to obtain the corresponding HS code. Experts can quickly identify the correct HS code for your product and provide additional information on the trade policies and regulations governing its exportation.

Check out Australia’s Free Trade Agreement (FTA) Portal for valuable resources on international trade.

Mistakes to Avoid When Obtaining an HS Code

Some mistakes can cause unnecessary fines, delays, or hinder your business’s growth. Here are some of the common pitfalls to avoid:

- Using the wrong HS code: Incorrect HS codes can result in incorrect tariffs being paid and delayed shipments. Moreover, obtaining the correct HS code for your product is one of the critical aspects of international trade compliance.

- Providing inaccurate product information: Providing incomplete or inaccurate information about your product can lead to the wrong classification of your goods. Not only will this affect your business’s bottom line, but this may also lead to customs seizing and even destroying the goods.

- Disregarding the importance of HS codes: HS codes are crucial to international trade, and you should treat them with the caution they deserve. A lack of understanding of HS codes can lead to losses in your business.

Seeking an Advance Ruling for HS Classification of Goods

If you are uncertain about the HS classification that applies to your goods, you can request an advance ruling. “Rulings” refer to the formal guidance given by a customs agency on how specific laws relating to imported goods are enforced. To obtain a ruling, an importer, exporter, producer, or their representatives can request a ruling and provide the required information. Advance rulings are issued to determine tariff classifications, customs valuation, and whether a product meets the conditions for being considered as originating under an agreement.

When in Doubt, Ask a Customs Broker

When in Doubt, Ask a Customs Broker

As the consequences of incorrect HS codes can directly affect your profit margin as well as the smooth running of your operations, seeking the help of customs brokers or international shipping professionals can ensure that you obtain the correct codes for your products.

At EES Shipping, we are committed to providing our clients with the best possible solutions to all of their customs brokerage needs. We also understand that every shipment is different, which is why we offer tailor-made solutions catered to each individual client. Contact us today for more information.

HS Codes FAQs

What happens if you use the wrong HS code?

Using the wrong HS code can lead to fines, delays, and even the seizure of your goods. So, it’s best to ensure that you have the correct HS code for your product.

Do all countries use the same HS codes?

There are currently more than 200 countries using the HS for international shipments. The first six digits of the codes will adhere to the Harmonised System, whereas the latter part of the code may include country-specific digits (also called HTS codes) that indicate additional product classifications.

What are HTS codes?

Harmonised Tariff Schedule (HTS) codes are country-specific codes that are governed by each individual country’s customs department. For example, HTS codes in the UK (aka commodity codes) are issued and controlled by the UK’s customs authority, His Majesty’s Revenue & Customs (HMRC).